Salary Sacrifice - It's Good To Go Green!

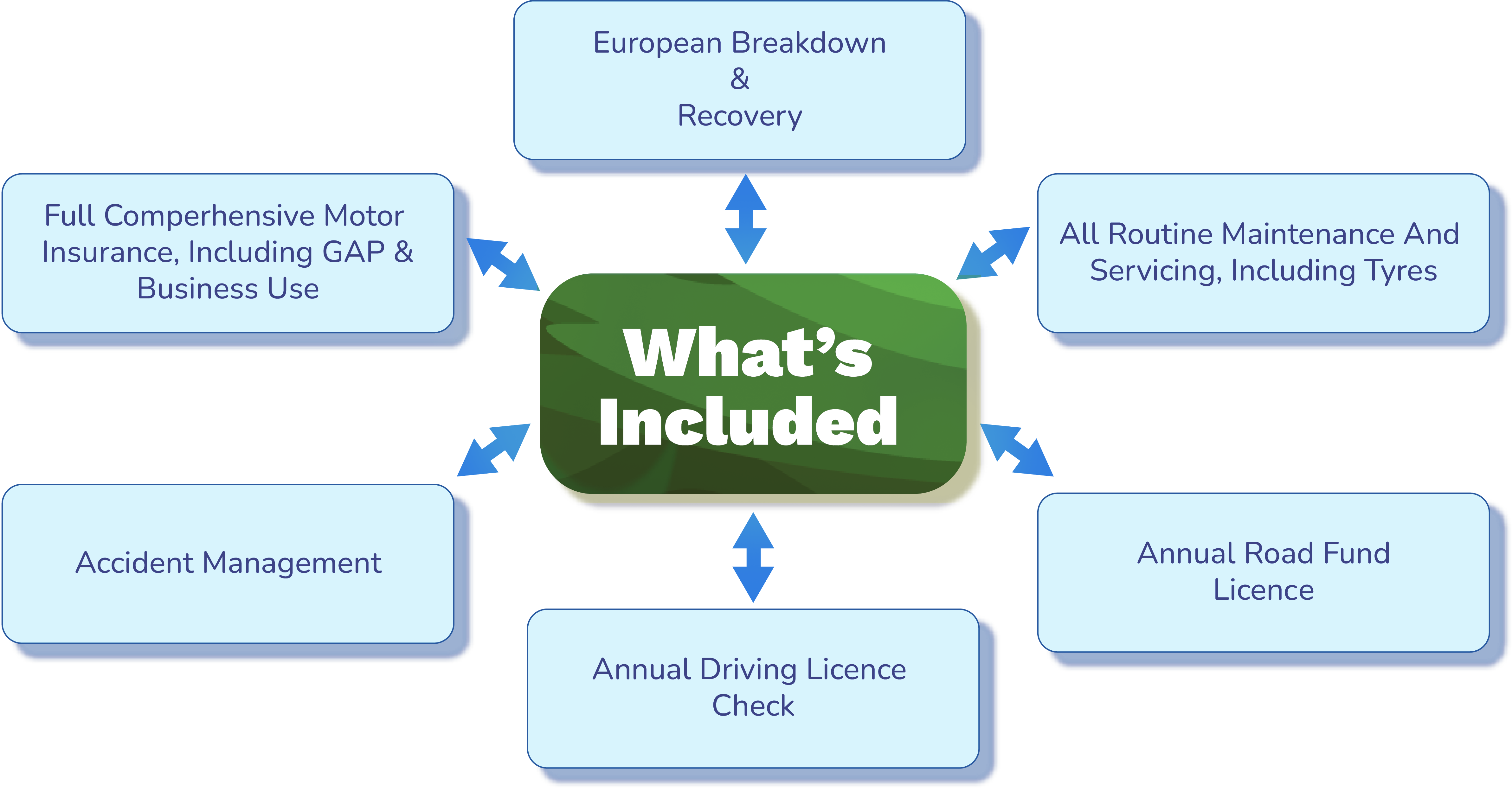

We are delighted to introduce to you our market leading, Salary Sacrifice Car Leasing scheme.

Salary sacrifice is creating all the hype in the business sector as fleets across the UK switch to electric vehicles. With all of the benefits available on our scheme locked in until 2028, we wouldn’t want you to miss out on this opportunity. Reducing all of our carbon footprints is high on everyone’s agenda and this scheme certainly ticks that box along with all the savings for both the employee and employer. Our salary sacrifice scheme will boost the recruitment and retention of colleagues in your business whist supporting your HR team in the daily management of this very popular benefit.